Noqoody: Solving AML Problems Via Collective Intelligence

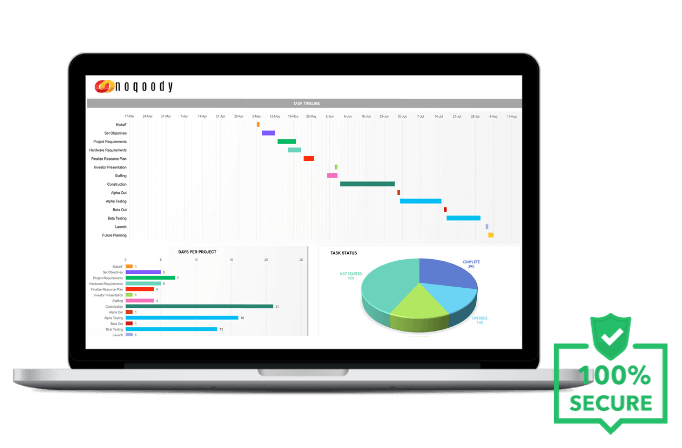

As money laundering techniques are growing in volume and complexity, banks can no longer sustain fighting financial crimes the conventional way by just focussing on rules-based, siloed detection with no or limited insights from peer banks. This system begins with analysing the current state of the AML Transaction Monitoring (TM) ecosystem, highlighting the challenges across legacy systems and traditional machine learning applications. In the next segment, the paper highlights Noqoody’s AML innovation in TM through Typology Repository Management (TRM), a new way of detecting money laundering through collective intelligence and continuous learning. At Noqoody, we envision that this advanced machine learning approach will enable financial institutions to capture changing customer behaviour and stop the bad actors with high accuracy and speed, improving returns and risk coverage.

- Evolution of Detection

- TRM: AML Revolution

- Smart Money Safeguard

- Collective Intelligence Triumph

- Adaptive Risk Prevention

- Precision in Safeguarding

EN

EN

العربيّة

العربيّة